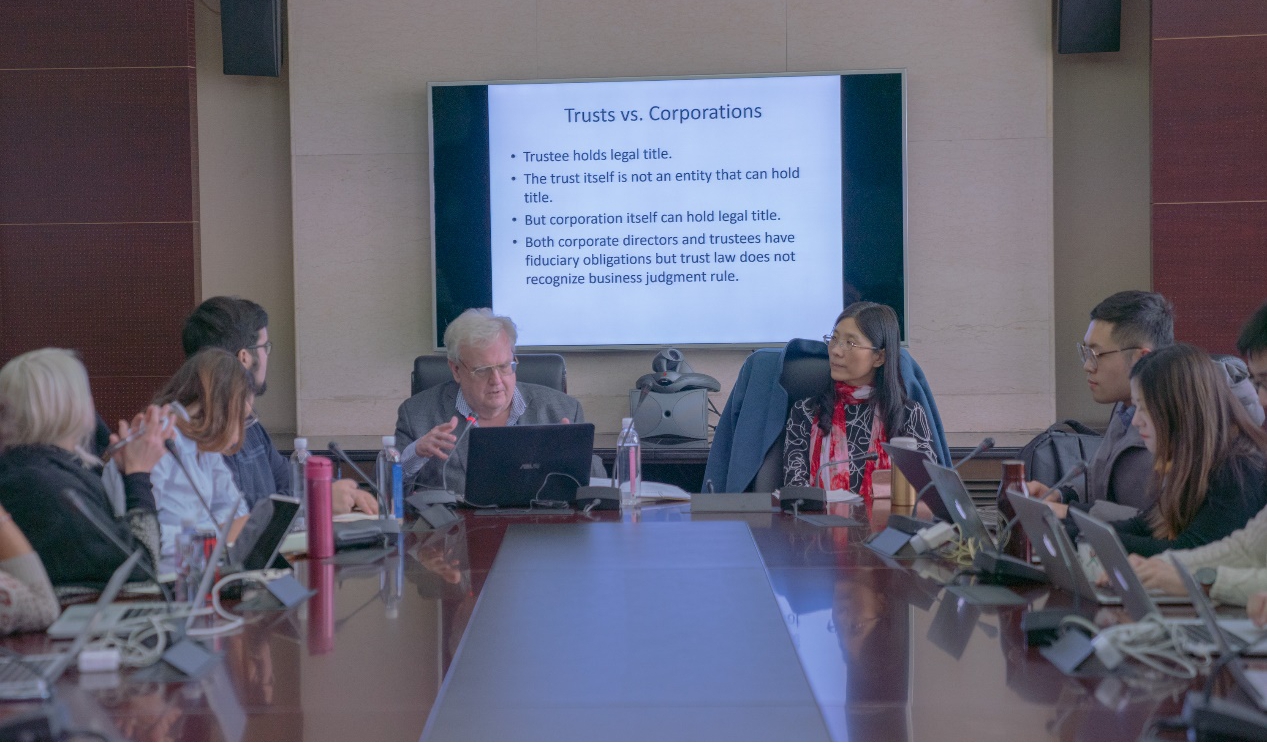

David M. English, Professor of Law at University of Missouri, was invited to speak at Fudan Law School on “The Function of the Trust in Asset Management” on November 26. Prof. English was the Reporter (principal drafter) for the Uniform Trust Code (UTC), and was invited to participate in a Chinese legislative consultation seminar prior to the enactment of the Trust Law of the PRC of 2001. Ms. Vice Dean Li CHEN met and talked with Prof. English on behalf of the Law School before his lecture, and Prof. Lingyun GAO hosted his talk. The participants included Mr. Li CHEN, Associate Professor of the Law School, Fudan alumni and lawyers from Allbright Law Offices and Hanshen Law firm, the international students of the LL.M. Program in Chinese Business Law, the students from the Dual Degree J.M. Program, and many other students from the regular LL.M. and J.M. programs.

Professor English started his lecture from defining the trust as “ a method for managing property,” and then emphasized one of the essential principles of the trust, which is “the Trustee holds legal title to the trust assets and has a fiduciary duty to the beneficiaries.”

After introducing some basic concepts, Prof. English compared trust with a few other legal systems. Firstly, he compared trust with corporation and pointed out that a trust cannot hold legal title but a corporation can. It is the trustee who holds legal title in a trust. Secondly, he compared trust with agency. A trustee holds legal title to trust property and owes specific duties to the beneficiaries, while an agent owes duties to the principal but the principal continues to hold the title. Prof. English also expressed his view on Chinese trust law. In China, the Trust Law is a national law, but in the United States, the trust law is mostly controlled by each state whose laws are not always the same.

Prof. English also introduced a few typical types of commercial trusts, such as pension trusts, mutual funds, REITs, mineral royalty trusts, asset securitization, and bond trustee. From his perspective, commercial trusts have many advantages. For example, the trust assets are segregated from the trustee’s own property and protected against the trustee’s bankruptcy. And the business trust usually enjoys more favorable tax treatment and is generally more flexible.

In the Q&A session, Prof. Gao discussed with Prof. English about some topics like Hague Convention on the Law Applicable to Trusts and on Their Recognition. Many students also exchanged opinions with Prof. English on some theoretical or practical problems of the trust law, like the dual ownership theory in some civil law countries, the true sale of trust property, the dispute settlement of trust, the disclaimer of beneficial rights, and issues on the charitable trusts. In conclusion, Prof. English commented that “the trust law in China is now in a very basic level and is based more on the contract rather than the property theory.” The lecture ended successfully in the end of the heated discussion.

Reporters: Guanyun Qi, Liujie Shen